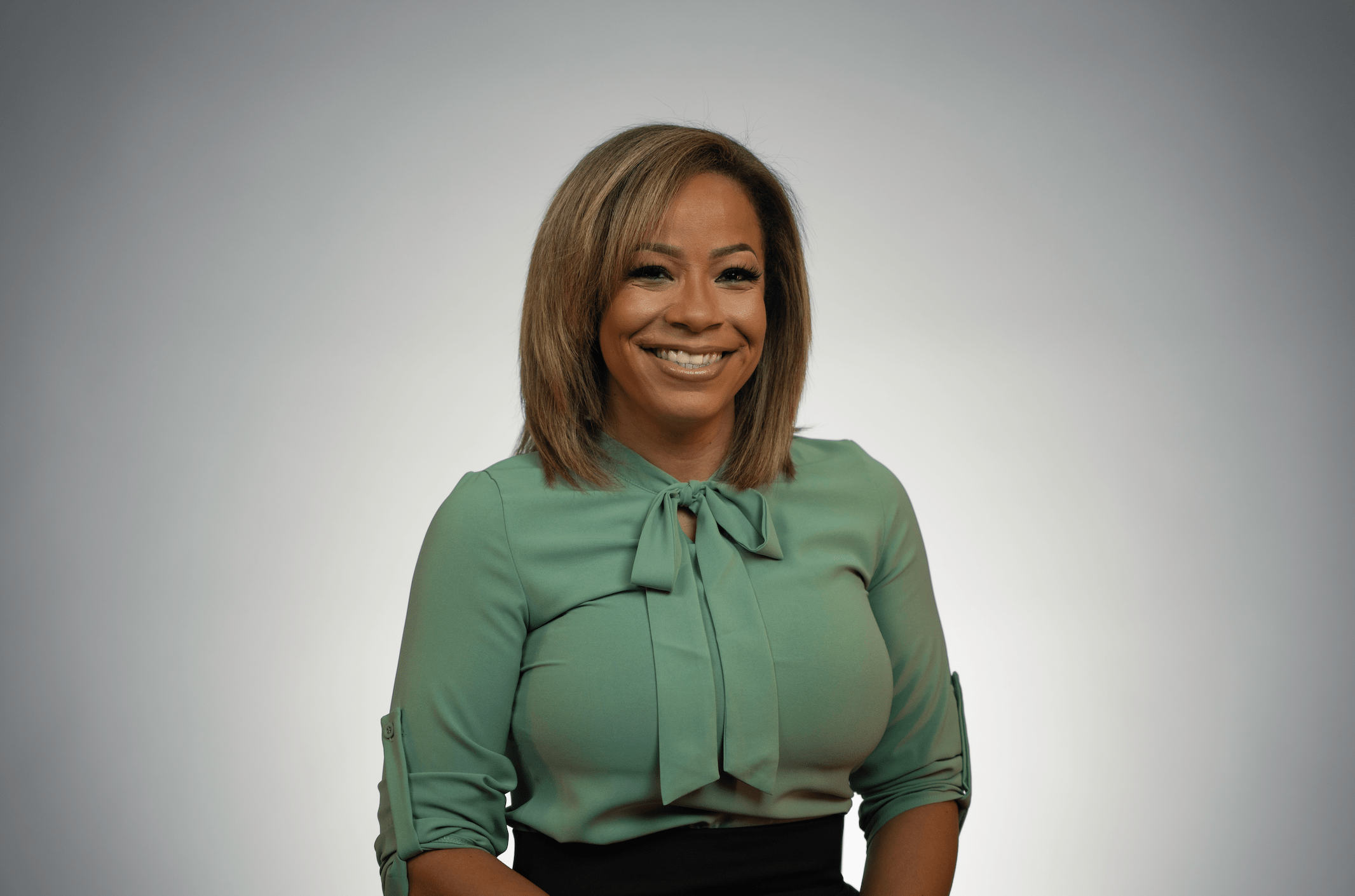

KelliWorks, the virtual accounting firm started by Kelli Lewis, a small business expert, helps small and mid-sized businesses understand the problems of financial instability. She uses her experience to guide them towards enhancing their accounting knowledge, and with the help of KelliWorks they can keep their businesses healthy and thriving. The financial department is the backbone of any business, and without a properly functioning accounts section, no company can achieve growth and success. Kelli Lewis steps in here with her virtual accounting firm, as she aptly puts it, “KelliWorks, so you don’t have to”.

With Kelli’s years of experience in accounts, she is aware of the pitfalls that can hinder small and mid-sized businesses without a properly functioning financial section. These businesses need to change their tactics of hiring staff who lack good accounting knowledge so that the small and mid-sized businesses can keep up the pace caused due to changing times and technology. Kelli’s interaction with these entrepreneurs made her realize how confused and overwhelmed they were when it came to taking the businesses forward without compromising on excellence.

Financial Pitfalls that Hinder the Growth of Small Businesses

Kelli focuses on the financials of small and mid-sized businesses, and she discusses the main financial hurdles that can cause complexities. They need to be addressed properly, and this is where KelliWorks steps in to ensure the smooth operations of these businesses so that the entrepreneurs see the growth of their organizations. Some of the pitfalls Kelli sees and requires to be rectified are: –

Mixing Business and Personal Finances

Kelli stresses the importance of having a proper divide between personal accounts and business accounts. Often, not having a proper divide complicates the financial management of the businesses. It is also a way of complying with the tax laws. This lack of proper demarcation between personal and business accounts is seen a lot in these small businesses, and KelliWorks helps these businesses mark that boundary. With this, financial dealings and managing become easy.

Neglecting Cash Flow Management

One thing Kelli noticed while working with these businesses is how they are focused on the profits and do not keep track of the money that is coming in or going out. A proper cash flow should be implemented to steer clear of financial strains. KelliWorks helps to track the cash flow and gives a forecast of the expected income and expenses. The firm guides these small and mid-size businesses to plan meticulously to meet their financial obligations.

Over-reliance on Manual Processes

With the advent of technology, it is time to make that smooth transition from manual accounting and spreadsheets to modern methods of accounting. Using accounting software helps reduce accounting mistakes, and the tools streamline the processes and work well in giving insights on the financials of the businesses. Outdated systems cannot help anymore in detecting accounting errors, and KelliWorks guides them through the process of technology-driven accounting so that the needs of these businesses are met.

Kelli Lewis understands the need to investigate the above-mentioned flaws in these small and mid-sized businesses, and keeping in mind her experience as a small business expert, she gives her time and experience to reshape the accounting and business scenarios that prevail in this generation.

Looking to stay ahead in your accounting and financial department, and not knowing how to proceed? Contact KelliWorks to help with their latest accounting software and systems so that your financial department is well-operational using their customized solutions and tech-driven accounting processes. The firm understands the uniqueness and requirements of each business and navigates through the complexities and requirements accordingly.